Iraq activates new deal to pay Iran for gas

Swap of Iraqi refined products for Iranian gas could help settle an $11 billion debt but also risks friction with U.S. over sanctions.

Iraq has activated a new mechanism for making payments to Iran for gas imports in an apparent attempt to settle billions of dollars in debts that have accumulated because of U.S. sanctions and banking restrictions.

Under the new deal, Iran is nominating companies to load refined products from refineries in Iraq, according to three senior Iraqi officials familiar with the structure of the agreement. When those products are sold, buyers pay Iran rather than Iraq, and the amounts are deducted from Iraq's debt to Iran.

"We cannot sell directly to [Iran] because we are bound by American instructions," said one senior Iraqi oil official. "But in exchange for Iranian gas, we sell to companies nominated by the Iranians and authorized by Iran, and these companies in turn sell the product on behalf of the Iranians.... We inform the Iranians of the sale value and deduct it from the debt for Iranian gas."

A second senior Iraqi official confirmed the structure of the trade, and described it as the product of a "political agreement" between the Iranian government and the Coordination Framework, an alliance of Iraqi political parties backed by Iran that forms the backbone of Prime Minister Mohammed Shia al-Sudani's governing coalition.

"There is $11 billion in debt that Iraq owes for imported gas," the second Iraqi official said. "The deal will continue until the $11 billion debt is paid down."

Iraq imports gas from pipelines that enter in Basra and Diyala provinces, with gas going to several power plants. In exchange, Iraq’s Electricity Ministry has deposited payments in the National Iranian Gas Company’s (NIGC) account at the Trade Bank of Iraq (TBI) — but Iran has not been able to repatriate that money because of U.S. sanctions.

Iraq "deposits money into these restricted accounts, and then we issue these waivers," said State Department Spokesperson Matthew Miller in a March 14 press briefing. "[The waiver] allows the money in... those accounts to be used for humanitarian and other non-sanctionable purposes, but the money itself doesn't actually move from Iraq to Iran."

It is not clear whether the U.S. government is aware of the new swap deal, which appears to give Iran access to cash without the same restrictions as the TBI mechanism. In response to a query, a State Department spokesperson said, "We refer you to the U.S. Department of the Treasury." The Treasury Department could not be reached for comment in time for publication.

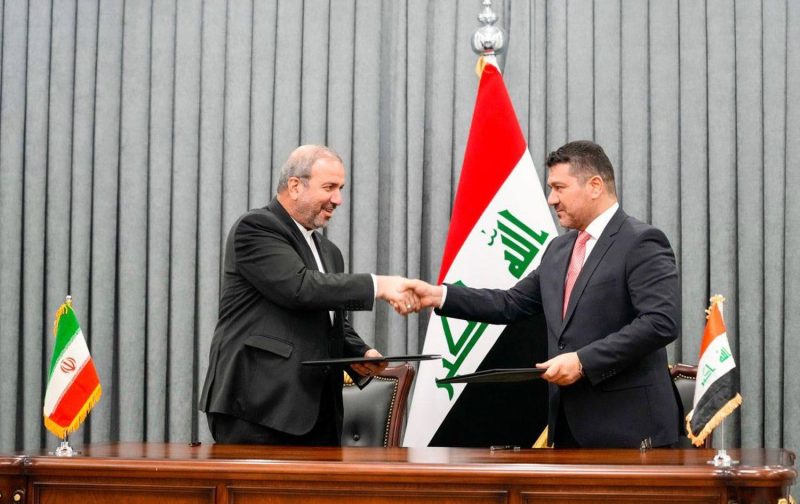

The swap deal was first approved by Sudani's Cabinet in July 2023. At the time, Sudani said the plan would create “cost savings” for Iraq and “prevent recurring disruptions” to the country’s electricity grid.

According to a Cabinet statement at the time, the July decision authorized Iraq's oil marketing company (SOMO) to establish “the necessary marketing and contractual procedures” and “sign contracts with companies nominated by the Iranian side, exempt from the controls and instructions approved by SOMO.”

The details of the trade now appear to be fleshed out and put into action, according to two senior Iraqi officials.

SOMO has now signed five contracts with companies nominated by Iran to receive both high-sulfur fuel oil (HSFO) and naphtha directly from refineries in southern Iraq, the two senior officials said. The companies take ownership of the cargo at the refinery loading points and are responsible for arranging transportation, subcontracting with multiple Iraqi companies.

The products are then trucked both by land into Iran and to southern Iraqi ports for export by sea, the two senior Iraqi officials said.

The companies nominated by Iran "carry a letter of authorization stamped with the stamp of the Iranian embassy in Baghdad," said one of the Iraqi officials.

The trade makes economic sense for Iraq, which generates a problematic surplus of HSFO. Iraq used to sell large volumes of fuel oil for use as "bunker fuel" that is used to power ship engines, but new international regulations went into effect in January 2020 that dramatically lowered the maximum sulfur content allowed in bunker fuel — a significant benefit to the environment and coastal communities that suffered from dirty emissions, but a setback for countries like Iraq that lack the modern refining equipment to remove sulfur and generate compliant fuel oil.

Iran is apparently willing to find buyers for the HSFO, however. So the swap deal appears to help Iraq pay down debts while also serving some of Iran's financial goals.

The swap deal could also create friction with the U.S. Unlike the TBI payment mechanism, the new deal does not appear to provide any guarantee that Iran's revenue from gas sales to Iraq will be only be used for benign purposes.

"The contracts say we should export until we have settled the total amount [owed to Iran]," said one of the senior Iraqi officials. "That is, $11 billion."

Iraqi staff reporting from Nassiriya are anonymous for their security. Lizzie Porter reported from Istanbul. Ben Van Heuvelen reported from the United States.